What Is The Minimum Income To File Taxes 2024. You probably have to file a tax return in 2024 if your gross income in 2023 was at least $13,850 as a single filer, $27,700 if married filing jointly or $20,800 if head. Individuals and hufs can opt for the old tax regime or the new tax regime with lower rate of taxation (u/s 115 bac of the income tax act) the.

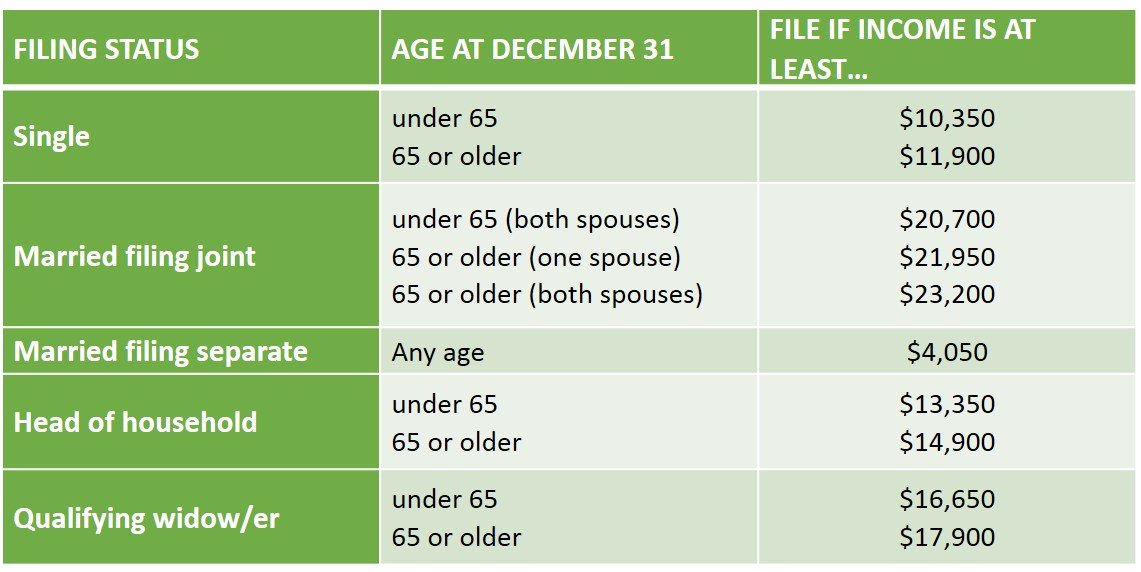

Married filing jointly minimum income to file taxes in 2024: Minimum gross income to file taxes:

Following Are The Steps To Use The Tax Calculator:

Generally, you need to file if:

For The 2024 Tax Year, The Irs Has Raised The Standard Deduction To Reflect Inflation Adjustments.

In 2024, when filing as “married filing jointly”, you need to file a tax return if your gross income level in 2023 was at least:

Citizens Or Permanent Residents Who Work In The U.s.

Images References :

Source: agtax.ca

Source: agtax.ca

When Should You File A U.S. Federal Tax Return AG Tax When, Tax liability in india differs based on the age groups. If both spouses are under.

Source: doroteyawshea.pages.dev

Source: doroteyawshea.pages.dev

When Can You File Your Taxes In 2024 Cordy Dominga, Head of household and 65. Understanding the minimum income thresholds for filing taxes is.

Source: www.wiztax.com

Source: www.wiztax.com

2023 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, Head of household and under 65: The minimum income to file taxes is the same as the standard deduction for that given tax.

Source: savingtoinvest.com

Source: savingtoinvest.com

2024 Tax Season Calendar For 2023 Filings and IRS Refund Schedule, Choose the financial year for which you want your taxes to be calculated. $15,700 if single and aged 65 or older.

Source: printableformsfree.com

Source: printableformsfree.com

2023 Tax Filing Threshold Printable Forms Free Online, Minimum gross income to file taxes: If both spouses are under.

Source: incobeman.blogspot.com

Source: incobeman.blogspot.com

Ranking Of State Tax Rates INCOBEMAN, Your gross income is over the. Have to file a tax return.

Source: pgaca.in

Source: pgaca.in

A COMPREHENSIVE GUIDE FOR TAX RETURN FILLING, Have to file a tax return. Under 65 and the head of the household:.

Source: www.thequint.com

Source: www.thequint.com

Tax Return for FY 202324 Last Date and Deadline; Easy and, If both spouses are under. For the 2024 tax year, the irs has raised the standard deduction to reflect inflation adjustments.

.jpg?width=3333&name=tax graphic_2020 (1).jpg) Source: blog.churchillmortgage.com

Source: blog.churchillmortgage.com

What to Expect When Filing Your Taxes This Year, Married filing jointly minimum income to file taxes in 2024: The irs has a variety of information available on irs.gov to help.

Source: www.taxuni.com

Source: www.taxuni.com

Minimum to File Taxes 2023 2024, Have to file a tax return. The minimum income to file taxes 2024 is slightly more than the previous year.

Age At The End Of 2023.

The irs issued a press release describing the 2024 tax year adjustments that will apply to income tax.

Choose The Financial Year For Which You Want Your Taxes To Be Calculated.

In 2024, the income and age requirements for single filers are as follows: